INTRODUCTION

During the phase of global financial crisis and the great depression, which has incurred the great economic loss to all the countries, whether developed or underdeveloped,. The impacts of such financial drawbacks leads the banking sector and financial institutions to bankruptcy. Therefore, there were no funds or resources available in the banks to operate their activities. It has invited various issues and obstacles in the countries like EU, USA and UK on which they have experienced obstacles like inflation, GDP rate, Recession and unemployment. UK government has made various efforts in designing the financial policies and plans to overcome such a crisis.

1. Determining difference between Recession and Depression

|

Recession |

Depression |

|

This is the factor which indicates the negative fall of economy consistently for the two quarters. It is necessary for economy in terms of analysing the GDP rate. Additionally, it is the factors which help in analysing the per capita income of the citizens as well as the economic condition in the country. |

It is also a downturn in the economy, which reflects the negative balance but it was for a longer period. Moreover, the recession is for short-term period, while depression will be denoted as the long-term period. It impacts when the GDP has more than 10% of reduction (Schwaab, Koopman and Lucas, 2017). |

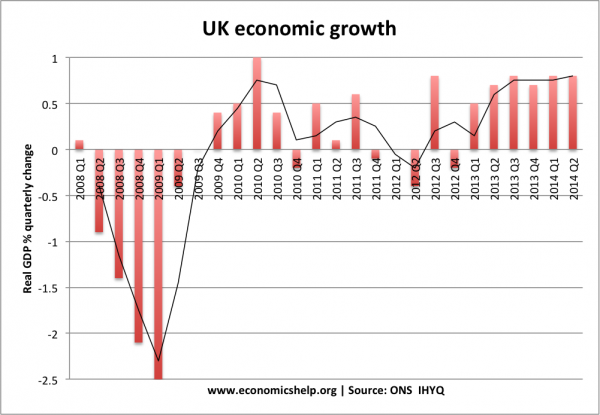

2 Impact of global crisis on UK

The impacts of global crisis on UK economy, which has threatened the economic conditions as inviting inflation, recession, etc. have become serious issues for the government to sort out (Lin and Ye, 2017). Therefore, during the phase of Global financial crisis, which damages the national economy and has affected the national financial conditions, such as:

- shortage of liquidity in banks and financial institutions led the credit crunch.

- The financial instability reflected in fall of consumer business and confidence.

- The global recession impacts trade practices of countries, which reduces exports and reciprocally increases imports.

- The GDP rate of nation has been falling due to Fiscal austerity.

3. Impacts of Credit Crunch over economies

There has been various impacts of credit crunch on the economies of several countries; the main reasons behind among such issues were.

- The rise in the rate of interest leads to the sudden shortage of funds in the banks. For instance, 15% of the interest was in UK in 1992.

- The influence of governmental parties in controlling the money (Guerrieri and Lorenzoni, 2017).

- There has been reduction of funds in the capital market.

4. Business which will not be affected by the economic downturn

There are various organisation that are not being affected by the global crunch in UK, such as Lehman Brothers, The Pier, MFI, Land of Leather, and Ilva; these are the retail industries. It is because they had reduced the consumers credit down. In relation to transport organisation British Airways, it has the better budgeting techniques on which credit crunch does not bother them (UK recession: winners and losers, 2010).

REFERENCES

- Guerrieri, V. and Lorenzoni, G., 2017. Credit crises, precautionary savings, and the liquidity trap. The Quarterly Journal of Economics. 132(3). pp. 1427-1467.

- Lin, S. and Ye, H., 2017. Foreign Direct Investment, Trade Credit, and Transmission of Global Liquidity Shocks: Evidence from Chinese Manufacturing Firms. The Review of Financial Studies. 31(1). pp. 206-238.

- Schwaab, B., Koopman, S. J. and Lucas, A., 2017. Global credit risk: World, country and industry factors. Journal of Applied Econometrics. 32(2). pp. 296-317.

Company

Company