INTRODUCTION

A financial market is a place where people trade financial securities, bonds, and some other underlying assets that reflect total supply and demand at that particular period. It includes precious metals and other agricultural products. It is a wider term that describes any marketplace where trading can be done by currencies and derivatives. Costs in a financial market are determined by making specific changes in the rules and regulations. This particular project provides crucial information about the different operations of financial markets and is valuable to an individual or company (Takayasu, 2013).

Certain theories and methods are being used in financial markets that consist of efficient market hypotheses as well as their related implications. Analysis of operations and efficiency of financial markets are discussed in this report. To determine and collect valuable financial information and indices that consist of share prices to operate proper analysis of operations as well as their efficiency in the marketplace.

Q1

(a): Distinguish Among Various Levels of Market Efficiency

An 'efficient market is stated as an appropriate market in which there is a large number of rational, profit maximization actively competing with trying to predict the future market value of individual securities. In an efficient market, competition between many intelligent participants leads to a tough situation, where at any stage the actual prices of individual securities already reflect the effects of data. In other words, in an efficient market, there is a point in time when the actual prices of securities will be positively estimated at intrinsic value. There are mainly three levels of market efficiency. Some of them are discussed below:

Weak form efficiency: In this, the prices of the securities instantly reflect all data of the past prices (Breedon, Chadha, and Waters, 2012.). It included future price movements that would not be estimated by using last year's prices. All data related to past inventory prices is of no use in predicting upcoming stock price deviations.

Semi-Strong efficiency: It refers to asset price, which fully reflects every publicly published data. Henceforth, only investors and other stakeholders with extra inside data would have plenty of benefits in the market. It has been determined that the strong form is theoretically related to persuasive, and then the semi-strong form is the past request that is present in our common senses. It says that the market will quickly digest the publication of related information by moving price fluctuations to a new equilibrium level that varies from the overall supply and demand that is caused by the emergence of data.

Strong form efficiency: It is known as the price of the asset that fully reflects every public and internal information that is available to the company. Henceforth, no other one has a benefit in the market in predicting cost; thus, no information would be provided at an extra value to outside stakeholders and investors. In case the current market price is lower than the value cost, which is justified by some other piece of private data (Mayntz, 2012).

Efficiency market theory: It is known as an important investment theory that states that it is impossible to beat the market because market efficiency would cause existing share prices to incorporate and reflect every piece of information reliably. It is a kind of modern theory of finance as a good starting theory that is efficient in the capital market.

In 1970, Eugene Fama published in their article that besides the meaning of efficient markets, there was also a distinction among the three forms of efficiency: weak, semi-strong, and strong aspects. The efficient market hypothesis and attitude of finance theory have been the main aspects of modern asset pricing for the next few years. Apart from this, certain theories effectively explain asset pricing. It happens to be a major research area in specialized literature.

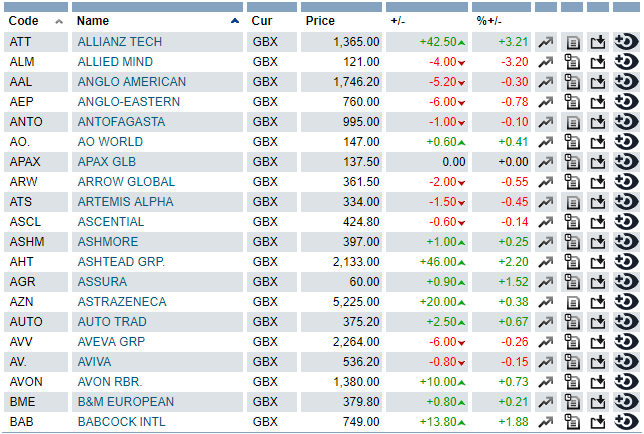

FTSE all share and trend:

(b): Critical Assessment of the “Efficiency” of the London Stock Exchange (LSE) Market

The main important aspect of this particular theory of efficiency market provides crucial information about the last couple of years' performance of the LSE market position. This hypothesis is said to be a fundamental aspect of the financial model and has a significant impact while making decisions from investors as well as other financial managers. As per the efficient market hypothesis of the inventory market, the securities prices reflect every piece of information which is indifferent and cost-efficient. This data is more commonly present for all investors so that everybody can have absolute and incurred comparative benefits for some assets concerning increasing maximum growth for the company (Claessens and Forbes, 2013).

Henceforth, under this hypothesis of the market effectively, even if there are more profitable opportunities, an investor will realize more quickly, and hence, the market will remain balanced for a longer period. It has been determined that various types of EMH assumptions exist in a perfect capital market. Thus, the capital market is more intensely competitive, and asset prices are more hard to undervalue or overvalue more reliably. Because of this, investors would not be able to make abnormal gains in their overall transactions. Based on the undertaken capital investment risk, they would be able to earn a reasonable market return. In respect to keeping the perfect market analysis, all associated assumptions would be taken into account.

- Initially, there are no taxes to be paid.

- Secondly, all investors and stakeholders have the same available data.

- Lastly, there are no agency costs to be connected with the stock ownership as well and no transaction costs arise for an individual that is associated with buying and selling securities or any other shares.

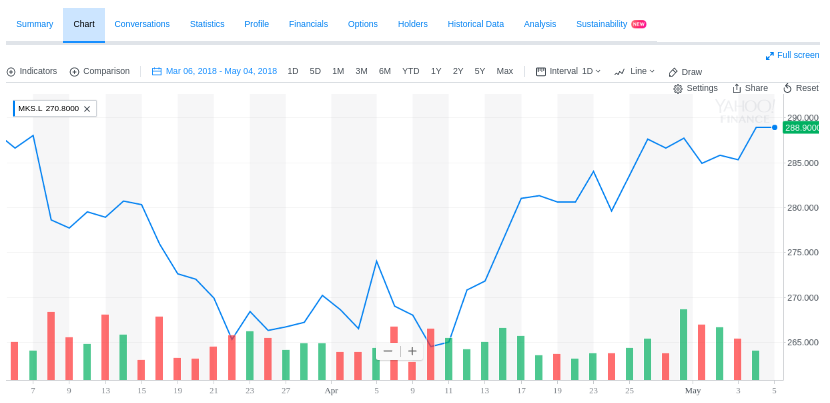

LSE (London Stock Exchange) is a stock exchange that is situated in the UK. It is one of the fourth largest stock exchanges at the international level after the Tokyo Stock Exchange. It has been seen that total market capitalization of GBP 3,396 billion in the past 2012 year. It is considered that the LSE is one of the most appropriate stock exchanges out of 3000 companies from more than 70 nations. It had been admitted to trade on their market more economically. One of the most successful and dynamic industries as compared to other stock markets. It has over more than 500 firms, most of which are banks and stockbroker's members. The major aspect of this stock market is that from so many years they have the history started in the past 300 years ago in coffee houses in the 17th century in the UK. It was more vastly formulated in strong and well-regulated stock exchange places (Gigineishvili, 2012). Marks & Spencer is one of the leading retail companies that is more effective. It was selected because the market position of this company is more effective as compared to other companies.

There is certain evidence against the efficient market hypothesis:

It has been found that empirical evidence that supports the weak-form and semi-strong forms of EMH has no uniformity of acceptance. Plenty of investment professionals will still meet the EMH with an appropriate deal for their specific client.

Over-reaction and under-reaction: It is known as an efficient market hypothesis that implies that investors would react quickly and remain unbiased in reliable ways to new information. They need to determine that stocks with low long-term past returns tend to have more future returns and vice versa. It is said to be a huge challenge to the efficient market hypothesis, which an individual often overreacts to and underreacts to new ones (Weinstein, 2011).

Value versus growth: It is said to be essential for investment professionals and academics that guide us to create maximum value for the company regularly. Typically, it is a value of strategies that consists of buying stocks that have low prices, which is related to accounting books of accounting such as dividends and historical prices.

Small firm's effects: According to these particular effects, it has been found that the average return on small inventory was too large to deal with the capital asset pricing model. While average returns on wide stocks were too minimal. Research indicators that are most of the difference in comparison to small and large inventory every month.

Various types of activities are categories and are represented underneath:

Primary market: The LSE allows UK and global companies to join the equity market in accordance to gain access to capital, and because of this, the outcomes result in increasing money, increasing their share capital, and obtaining a market valuation through the initial public offering process. Further, it gives great opportunities for various-sized companies to quote since it operates in different markets. Companies from around the world can list several products, which include secondary receipts and other debt obligations (Ahmed, 2013).

Secondary market: It is known as one of the most effective markets for doing trade on the main market and alternative market. The largest and most well-regulated companies from around the world are listed in the first marketplace. Over 1300 companies from almost 60 different nations enjoy the privileges of LSE. The FTSE 100 index is said to be the primary share index of the most highly capitalized UK companies that are listed on the main market. The second referred market is for smaller, growing nations. A lot of various industries are trying to join this market, which is asking to grow their capital. Moreover, various markets are associated with the trade market (Tumminello and et. al., 2012).

Trading: To maximize the liquidity of inventory, the LSE offers trading stocks that are essential for the company to increase its profitability position. It consists of the transfer of products from one individual or organization to another, often in exchange for wealth. It is an activity style of participating in financial sectors that seeks to increase overall traditional investing done by the company.

Information services: It is an effective form of the financial market that is used to provide information for a structure within an organization that is responsible for their data processing and recording of crucial data into their respective format. Every second of the trading day, the London Exchange uses to provide information ranging from individual trades and stock price shifts to companies' overall announcements.

Derivatives: It was created to bring the cash equity and derivatives places that are closer together. As valuable outcomes that expand the trading of derivatives while reducing the total risk and cost of the company.

Graph 1: Inflation rate:

The mentioned charts indicate the total rate of inflation, which is increased as per base rate %. There is an inverse relationship between inflation and interest rates. After 2008, it reduced drastically and remained constant till now.

Graph 2: Bank rate and policy rates

There is a direct relationship between the repo rate and lending rates which are being charged by Banks to various borrowers in the UK. Reduction of interest rate used to determine an economical monetary policy. It means that people would be able to borrow at a minimum rate from central banks to lend to their borrowers at reduced rates than earlier.

Graph 3: Bond rate in the EU

From the above bond rate, it has been seen that the organization line represents the rate in the UK market. It means that it is lower as compared to other countries' rates.

Graph 4: Bond price

According to these particular charts, it has been seen that the bond prices of the Bank of England represent a downward slope. It means that they are decreasing every year.

Graph 5: Quantitative easing of UK central banks

It is a kind of central bank such as the Bank of England used to create innovative money to make wide purchases of assets. It was a kind of policy in 2008 to start phasing out the negative interest rates the in UK.

Graph 6: FTSE 100

From the above charts, it has been seen that the FTSE 100 is open with 7.567.14 at a high rate of 7.598.51. The low rate it touches during the time is about 7.561.63. The share index of 100 top companies listed on the LSE with the highest capitalization rate.

Graph 7: Housing prices in London

According to the above chart, it has been seen that housing prices in London will go in the same direction as the inflation rate of the country. On the other hand, the FTSE market will also change as per the change in the inflation rate because it can be said that the rise in the inflation rate will also increase the FTSE market. In case a decrease in the inflation rate will also drop the market at the same point in time.

Stuck with your Assignment?

Hire our PROFESSIONAL ASSIGNMENT WRITERS and Get 100% Original Document on any Topic to Secure A+ Grade

Get Assignment Help

Q2

(a): Role and Function of Capital Market

The financial market is known as a systematic marketplace in which investors deal. It would provide a vehicle for the proper allocation of savings to overall capital investments. It can be categorized into money market and capital market. It has been found that both markets are crucial in financial sectors. In the capital market, it is said to be long-term securities. It is a market in which securities have indirect claims to capital investment. It plays a vital role in the alteration of an economy because it will provide a proper mode of transmission for the assembly of funds. This article is used to determine the comparison between money and capital markets (Financial Market Regulation, 2012).

|

Basis for comparison |

Money market |

Capital market |

|

Meaning |

It is known as an effective segment of the financial market that is leading dealings of short-term securities. |

It is an important financial management area where long-term securities are issued and traded. |

|

Nature of market |

It is said to be a more informal market. |

According to this, more formal types of markets are being determined by most of the investors. |

|

Risk |

In this particular market, the list is more low. |

It is comparatively high in the money market. |

|

Purpose |

To fulfill short-term credits required during an accounting year. |

To analyze the long-term credit requirements of an organization. |

Role: The role of the capital market is essential for inclusive growth in terms of wealth distribution and making effective capital investments for an investor as well as stakeholders. This would increase economic fiscal intermediation. It enhances the mobilization of savings and therefore improves efficiency and increases the capacity of investments.

FunctioVarious effective functions are needed to be followed in an organization. Some of them are discussed below:

- It would provide long-term funds that are necessary for investment decisions.

- With the help of this, investors can make identification of their total capital investments and their related viability (Titman, Keown, and Martin, 2017).

- It is used to facilitate international capital inflows.

A financial market is said to bring buyer and seller needs together to trade in asset prices such as stock, bonds, commodities, and currencies. The main purpose of using this particular market is to set costs for international trade, raise capital, and transfer liquidity as well as overall risk. Apart from this, component to financial place, two of the most similarly used are the money market and capital market. Money markets are used to analyze government and other entities as a means for lending and borrowing on a short-term basis. It is usually related to the assets that have been held for more than one year. Year markets are mainly used for long-term assets that are related to maturities of greater than one accounting period. It used to provide a wide variety of functions for both individuals and corporations at the same point in time. It has been seen that most of the company want to make their capital investments overnight and look to the money market to attain their essential needs and wants for the company.

Q.3

(a): Critical Evaluation of Potential Risks in International Transactions

It has been observed that there are various risk factors associated with international trade that consist of major barriers to growth in the same manner. Economists need to have differed on the real advantages of international trade. The total maximization of the export market is widely important to an economy. It is an essential aspect that can formulate an economy, but at the same time, specific domestic players can be outperformed through financial balance in multinational industries that become so important in more similar nations. It is more characteristically higher by international trade.

Risk: It refers to one of the main factors that are based on uncertain events or situations that, if they arise, have both positive and negative effects on a project's overall aims and objectives.

Uncertainty appreciation period: It is known as one of the specific abilities to assess the unlimited collection with an economical certainty, which is lacking at the time of increasing any claim.

Fluctuation period: It has been seen that normal hormone changes can cause overvaluation, which is to be more irregular in a given situation. It means that the company would start experiencing a loss period.

Depreciation period: It is the time at which the assets are available for use. It is said to be the location and situation that are necessary for the company to be capable of operating in the same manner.

Certain types of risks are associated with international trade, which can be divided into various types (Paul and Baschnagel, 2013). Such as:

Economic risks: The risk of concession is done to control economic aspects that are making huge impacts on the profitability of an organization. Risk of non-acceptance and protracted default in any marketplace.

Political risk: Certain crucial aspects are making huge impacts on the overall performance of an administration. There is some risk of non-renewal of import and export licenses to operate a business the most effectively. The risk of imposition of an import has been banned after the delivery of products all around the nation.

Commercial risk: It is an essential aspect which is associated with banks that lack of ability to honor their role and responsibilities. In this kind of situation, a buyer fails to comply to make payment because of financial obligations.

It has been determined that types of foreign exchange that a company can be exposed to transactions and economic exposure. In the case of some companies, international exchange risk will be managed from the center. The forward foreign exchange market would provide an option to the importer to make payment of their investment according to the rate at which interest is higher in other companies. It would ensure the future delivery of a foreign currency at a particular exchange rate. The cost at which the contract is being made is termed the forward rate. This is a sign to control the future risks that arise in an organization's case of making payments for imported products.

Chart showing Euro to the dollar.

- Spot rate: It is the rate at which foreign exchange contracts are being made by one party. This kind of rate changes drastically in some situations. It is the present rate at which two individuals make a contract to buy and sell securities.

- Foreign exchange rate: It is a kind of exchange sports transaction that is based on an agreement among two parties to buy one currency in respect to selling another currency at the agreed price for settlement on that particular date.

Graph: Both foreign exchange rate UK to Euro-currency

(b): Function of Euro-currency market

It is a kind of money market under which currency is kept in outside banks of the nations where it is legal tenders in case of borrowing and lending done by the banks during the period. This seems to be utilized by banks, multinational corporations, and mutual funds, as well as hedge funds that wish to regulate needs in the domestic market.

Certain important functions are associated with this market. Such as:

- These are the domestic currencies of one nation at the time of deposit in a second nation. For example, UK pounds denote deposits in banks outside of the United Kingdom.

- All banks in which Euros are deposited in Euro banks (Volosovych, 2011).

- It is known as a euro bank in a fiscal mediator that simultaneously bids for the time of deposits and makes loans in a currency other than that of nations that are situated in that particular nation.

It is necessary to allow the company to expand its market for both products and services that cannot have been available to that particular nation.

Pie chart of market size:

Advantages and disadvantages of useful for international transactions:

Various benefits are essential for increasing the growth of the market for the company. Such as:

- Lower purchased price or costs.

- Greater access to delivery products technology

- Improve the relationship with suppliers.

Limitations: It is not operating for some time; the continual short-term hedging of repeated transactions cannot limit the effectiveness of an organization. The chances of illegal transactions are greater.

Q4.

(a) Asymmetric information: It is said to be effective information that fails and occurs concerning one party to an economic transaction possessing high material information instead of another one. It is associated with the study of decisions that are related to various transactions.

(b): Moral hazard: It is a kind of situation under which one party gets involved in risky activities, determining that it is safe from all kinds of risk, and another individual would incur those costs.

(c): Adverse selection: In common terms, a situation in which sellers have data that buyers do not have regarding a few aspects of product quality. It is some kind of tendency for those in dangerous jobs or huge-risk lifestyles to get certain kinds of insurance.

Purpose of Regulation of Foreign Markets:

Certain regulations are in place to ensure that the markets are operating in effective requirement because there are certain environmental, social, and government products and services that are effective for the company. An individual must subject financial institutions to certain needs that are essential for the financial system. It is done to make proper regulation of all necessary transactions during the time to get more appropriate outcomes shortly time (McMorrow and Roeger, 2012).

CONCLUSION

From the above project report, it has been concluded that the financial market is an essential place to make trading of various effective rules and regulations to be followed when operating their business and safety They are aiming to regularize the integrity of financial systems in more appropriate ways. Role and functions of two important markets, such as money and capital markets.

REFERENCES

- Ahmed, A. D., 2013. Effects of financial liberalization on financial market development and economic performance of the SSA region: An empirical assessment. Economic Modelling. 30. pp. 261-273.

- Breedon, F., Chadha, J. S., and Waters, A., 2012. The financial market impact of UK quantitative easing. Oxford Review of Economic Policy. 28(4). pp. 702-728.

- Claessens, S., and Forbes, K. eds., 2013. International financial contagion. Springer Science & Business Media.

- Gigineishvili, M. N., 2011. Determinants of interest rate pass-through: Do macroeconomic conditions and financial market structure matter? (No. 11-176). International Monetary Fund.

- Mayntz, R., 2012. Crisis and Control: Institutional change in financial market regulation. Frankfurt am Main: Campus Verlag.

- McMorrow, K., and Roeger, W., 2012. The economic and financial market consequences of global aging. Springer Science & Business Media.

- Paul, W., and Baschnagel, J., 2013. Stochastic processes. Springer.

- Takayasu, H. ed., 2013. Empirical science of financial fluctuations: The advent of econophysics. Springer Science & Business Media.

- Titman, S., Keown, A. J., and Martin, J. D., 2017. Financial management: principles and applications. Pearson.

- Tumminello, M. and et. al., 2012. Identification of clusters of investors from their real trading activity in a financial market. New Journal of Physics. 14(1). p. 013041.

- Volosovych, V., 2011. Measuring financial market integration over the long run: Is there a U-shape? Journal of International Money and Finance. 30(7). pp. 1535-1561.

- Weinstein, B. A., CFPH LLC, 2011. Enhanced system and method for managing financial market information. U.S. Patent 7,890,396.

Company

Company