Writing Sample on Corporate Finance & Decision Making

Management of financial resources is crucial task by which company integrate all business activities in the direction of growth and success of the firm. Present report is based on General Sportswear private limited company which deals in sportswear of leading brands. Corporation is having issues related to liquidity crunch and heavy overdraft. In this regard various cost effective sources of finance are mentioned in the report. Further, budgeting and costing as effective techniques to control cash and increase profitability have been explained.

TASK 1

1.1 Sources of Finance

There are following sources of finance available for General Sportswear

Long Term:- The long term sources of finance consists of bank loan, leasing companies and hire purchase. It aids to expand business and raise long term capital in the direction of growth and success of the corporation.

Short Term:- Short term sources of finance consists of retained profit, personal savings and sale of old assets. It enables management to meet short term requirement of business and ensure consistent flow of production (Barton, 2001).

1.2 Implication of sources of Finance

As per the given scenario, it has been found that directors of General Sportswear were not in favor of debt finance. They assumed that it merely increases cost whereby profitability go down. This is because company has to pay cost of finance to out side party. At this juncture, it is not important that whether corporation is getting profitability or not. This affect performance to a great extent (Bhowmik and Saha, 2013). For example, if loan is taken by firm then management need to pay its interest on right time. Also, principle amount need to be paid within stipulated time.

1.3 Implication of sources of finance

According to the case study General Sportswear is planning to expand in the marketplace. In this regard appropriate sources of finance are retained profit, leasing companies. It helps to expand business corporation can acquire highly updated technologies from leasing companies. It helps to reduce financial burden because assets will be provided on rental basis. Furthermore, retained profit proves to be effective in acquiring material for the production activities (Graff, 2003). Apart from this, bank loan is also appropriate source for raising long term source for the firm. However, it generate additional cost for the firm but it is the effective alternative for expand business. Company can pay the bank loan back after recovery of initial investment. Apart from this, an alternative option may be financial institutions which supper such kind of organization. It enables General Sportswear to get finance at low interest rate and expand business in an effectual manner.

TASK 2

2.1 Analyze the cost of different sources of finance

Cost of finance can be tangible such as interest and dividends and there can be opportunity cost as well. Here, interest is fixed at the time of giving loan and time for payment of the same is also decided at the same time. Further, dividend is paid to shareholders wen corporation earn profit. In addition to this, opportunity cost incur because of use of retained earning in the expansion activities. Apart from this, tax decreases profitability of firm. This is because corporation need to pay cost of finance at first and then tax is paid. In such as cases profitability go down to great extent (James, Leavel and Mainam, 2002).

2.2 Importance of finance planning

Financial planning is very important for General Sportswear which gives upward direction to business. With the help of financial planning firm can control cash and profitability can be enhanced. Furthermore, financial planning helps management to select appropriate sources of finance so as to achieve organizational objectives. Similarly, effective tools and techniques like budgeting and costing are used in order to ensure optimum utilization of limited financial resources (Wildavsky, 2006).

2.3 Assessing financial information needs of three main decision makers

The main decision-makers are shareholders, suppliers and customers. These are directly or indirectly associated with firm and want to access wide range of information of company. For example shareholders attend board meeting so as to get detail information related to financial performance of firm. Further, suppliers access financial statements in order to analyze liquidity. At last customer get updates of General Sportswear with regards to new products and services.

2.4 Impact of finance on financial statement

The finance affect financial statement by increasing cost and decreasing profitability. For example profit and loss contain information related to interest and other charges paid for raising fiance from external sources (Richars, 2012). Further, balance sheet is the major statement which is affected by finance as it increase both side assets and liability in the same proportion.

TASK 3

3.1 Preparing a cash budget

| Months | January | February | March | April |

| Receipt | 50000 | 8740 | 7900 | -1860 |

| Sales | 11340 | 20160 | 21840 | 23260 |

| Total (A) | 61340 | 28900 | 29740 | 21500 |

| Payment | ||||

| Purchase | 1200 | 12100 | 13100 | 14100 |

| Expenses | 9400 | 6900 | 8500 | 9900 |

| Salary to store manager | 2000 | 2000 | 2000 | 2000 |

| Capital expenditure | 40000 | 8000 | ||

| Total (B | 52600 | 21000 | 31600 | 26000 |

| Deficit/surplus(A-B) | 8740 | 7900 | -1860 | -4500 |

According the above cash budget, it has been found that cash flow of company is going down due to due to high cost of production. However, it has to start new outlet owing to this capital expenditure took place. Furthermore, in last two moths General Sportswear is having negative cash flow which affects overall performance. At this juncture, it can be suggested to management to employees should be provided training so as to speed up in the flow of production. Also, cost of production should be decreased in order to increase profit.

3.2 Unit cost of products

| Cost | 30% mark-up on cost price | 25% on return on |

| Direct Material | 190000 | 190000 |

| Direct labour | 150000 | 150000 |

| Prime cost | 340000 | 340000 |

| Overheads(Fixed) | 100000 | 100000 |

| Total cost | 440000 | 440000 |

| Profit margin | 132000 | 250000 |

| Sales | 572000 | 690000 |

| Selling price/per unit | 286 | 345 |

As per the above table it is found that option two is generating high revenue. This is because by keeping 25% of capital employed company is able to recovered its cost and also gain 250000 as margin for the production of 2000 units. Corporate Finance Sample

3.3 Calculating the cost of each project

| Project 1 | Cumulative cash flow | Project 2 | Cumulative cash flow | |

| Years/Initial investment | 100000 | -100000 | 60000 | -60000 |

| 2 | 29000 | -71000 | 20000 | -40000 |

| 2 | 32000 | -39000 | 20000 | -20000 |

| 3 | 25000 | -14000 | 15000 | -5000 |

Table 4: Net present value of project 1 & 2

| Years | Project 1 | Project 2 | Present value at 10% | PV of project 1 | PV of project 2 |

| 1 | 29000 | 20000 | 0.909 | 26361 | 18180 |

| 2 | 32000 | 20000 | 0.826 | 26432 | 16520 |

| 3 | 25000 | 15000 | 0.751 | 18775 | 11265 |

| Residuel Value | 20000 | 15000 | 0.751 | 15020 | 11265 |

| Intial Investment | 100000 | 60000 | |||

| Net Present Value | -84980 | -48375 |

The above calculation depicts that both projects are generating negative revenue (as per payback and net present value method). However, according to accounting rate of return project 2 should be selected because it is generating high return for the firm. Furthermore, payback table is showing that initial investment cannot be covered in 3 years. Similarly, net present value also depicts that both of these project do not prove to be beneficial for Axis Ltd.

As per the above table it is found that option two is generating high revenue. This is because by keeping 25% of capital employed company is able to recovered its cost and also gain 250000 as margin for the production of 2000 units.

TASK 4

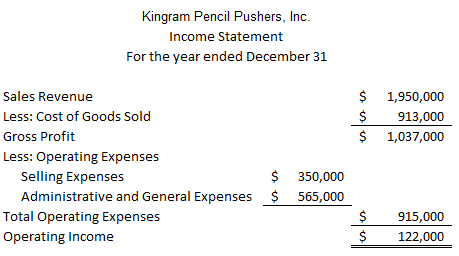

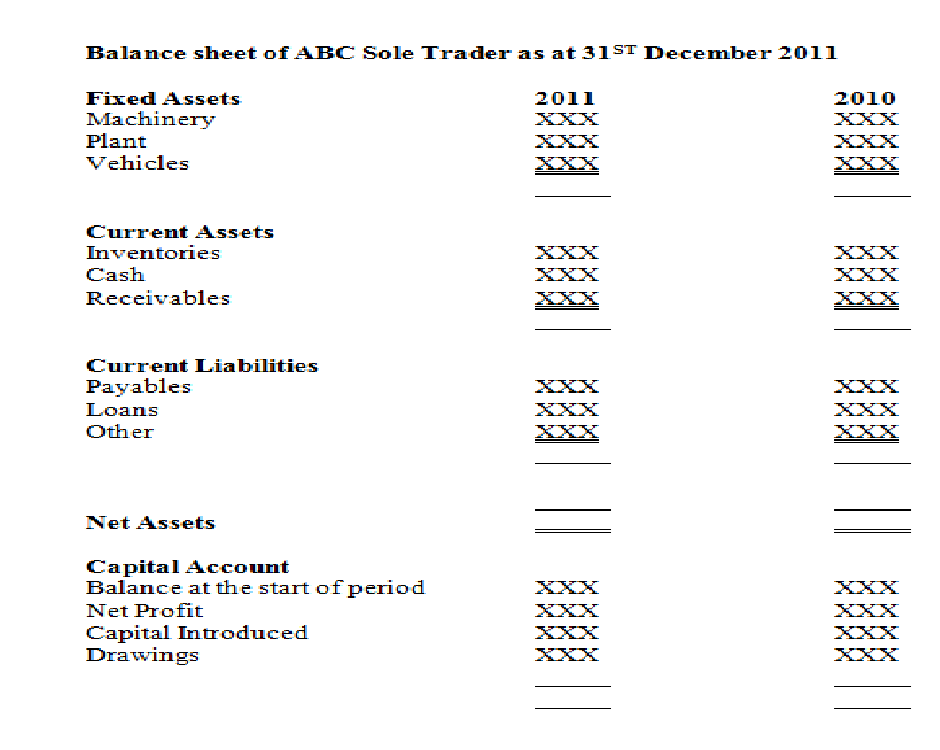

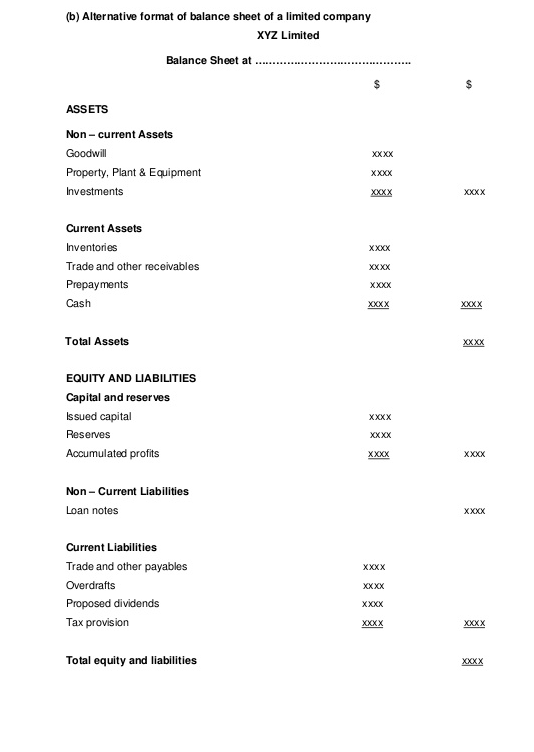

4.1 Main financial statements

There are three main financial statements such as balance sheet, profit and loss as well as fund flow statement. These financial statements enable management to keep record related to profit and loss of the firm (Liu and et.al., 2007). It aids to meet expectation of different stakeholders. Furthermore, income statement facilitates to keep record related to cost of finance such as interest. On the other hand, balance sheet consists of information related to assets and liabilities.

4.2 Compare appropriate formats of financial statements

All businesses keep financial statements in accordance with their requirement. For example sole trader makes simple profit and loss for keeping daily record whereas manufacturer also makes income statement. In addition to this companies with limited liabilities follow International Financial Reporting Standard and accordingly maintain all important financial statements (Lampe and Hofmann, 2013.). It has been shown as follows-

According to the above table it has found that return on capital employed of Comparator is 29.95% whereas other companies' ratio is 22.1%. On the other hand, debtors' and creditors collection period is also appropriate thereby balance can be maintained. Further, debt equity ratio of Comparator is 2 which depicts that costly sources of fiance has been accessed by the firm. Current ratio of corporation is 1.19 and quick ratio of the same is .64. It depicts that company has enough liquidity to meet its short term obligations. Similarly, net profit margin of Comparator and other companies is almost similar. In addition to this, total assets turnover is 2.13. Thus, it can be said that Comparator is also performing good at the marketplace and generating comparatively high rate of return. However, debt finance is high which can be harmful in long run growth of firm.

Conclusion

The aforementioned report concludes that several techniques like budgeting and costing are helpful in managing business performance. It aids to increase control cash and increase profitability. Further, ratio analysis is the effective means to assess financial performance of company which in turn investors invest money in the corporation.

According the above findings, it can be said that organization should properly analyze the cost of finance and then access those sources. It proves to be effective in increasing profitability and reducing cost of production.

References

- Barton, J., 2001. Does the Use of Financial Derivatives Affect Earnings Management Decisions. The Accounting Review.

- Bhowmik, K. S. and Saha, D., 2013. Sources of Finance. Financial Institution of the Marginalized India Studies in Business and Economics.

- Graff, M., 2003. Financial Development and Economic Growth in Corporist and Liberal Market Economies. Emerging Markets Finance and Trade.

- James, J., Leavel, H. W. and Mainam, B., 2002. Financial planning, managers, and college students. Managerial Finance.

- Lampe, K. and Hofmann, E., 2013. Financial statement analysis of logistics service providers: ways of enhancing performance. International Journal of Physical Distribution & Logistics Management.

- Liu. C. and et.al., 2007. Ratio analysis comparability between Chinese and Japanese firms. Journal of Asia Business Studies.

- Richars, G., 2012. University Intellectual Property: A Source of Finance and Impact. Harriman House Limited.

- Wildavsky, B. A., 2006. Budgeting And Governing. Transaction Publishers.

Company

Company